Bitcoin Ethereum and Ripple

In this article I will talk about the biggest 3 cryptocurrencies right now in my opinion. They are Bitcoin Ethereum and Ripple.

Not only they are the biggest three in terms of volumes and global adoption, but they each have their own peculiar features and very specific use cases. In the following sections I will analyze each of these cryptocurrencies.

The main things that will be discussed about them will be their history, their technical infrastructure, their financial data and some very simple but practical examples and use cases.

After reading this article you will be able to confidently outline the main characteristics of these three digital currencies, giving you a solid foundation knowledge.

Bitcoin (BTC)

It was the beginning of 2009. The investment banking company Lehman brothers collapsed a few months behind, creating a big earthquake in the financial world. It was the largest bankruptcy filed in US history.

This episode also made a big impact on a person or a group of people called “Satoshi Nakamoto”. The reason I say “person or group of people” is because nobody knows who Satoshi really is/are.

Satoshi Nakamoto published the Bitcoin whitepaper in October 31st, 2008. The whitepaper described bitcoin, a new digital currency that does not need any central intermediary to function. He solved the biggest dilemma of digital currencies: double-spending. He solved it in a revolutionary matter, which is decentralizing the currency’s record-keeping abilities and heavily using cryptography.

The bitcoin network was launched a few months after the release of the whitepaper, thanks to a group of online volunteers that ran the bitcoin core software in their own computers.

Within the bitcoin network there cannot be a “Lehman brothers” collapsing and taking away people’s money. You are your own bank. Let’s dive into how bitcoin works:

Traditionally all digital currencies were centralized, and a designated central institution would keep track of every balance and transaction. Satoshi figured out a way to remove that designated central institution and created a peer to peer network that would enforce the currency rules in a distributed, and most importantly transparent way.

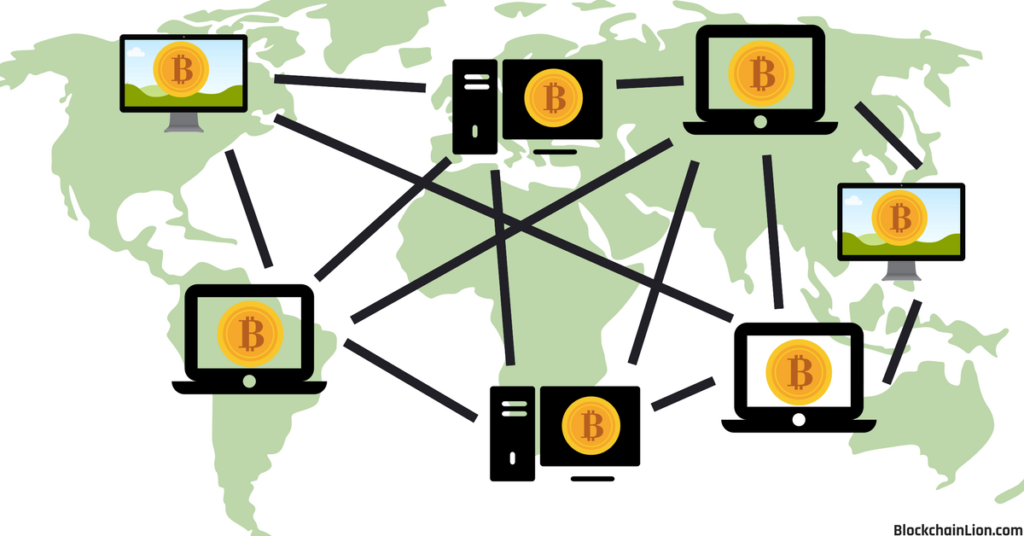

What does that mean? If you don’t know what a peer to peer network is, imagine thousands of computers, all connected with each other. Every member of the network is equipotent with other members and has equal privileges. in Bitcoin every member of the network holds records and checks transactions as they happen in real time.

The two technologies that allow this decentralized trust to happen are Asymmetric cryptography and cryptographic hashing.

At this point you might be a bit lost, I introduced some concepts and terms that are hard to link together. So let’s start connecting the dots and give a clearer description of the bitcoin network.

There are thousands of computers all over the world that decide to run the bitcoin core software, a software written in C++ by Satoshi and other developers. This software will allow your computer to enter and participate in the bitcoin network. Your computer now becomes a Node of the network.

By becoming a node in the network, your computer will start downloading the whole Blockchain database. Every node does that. The blockchain database is a chain of blocks, where each block contains data about past transactions and balances. Therefore the blockchain is a file located on every node in the network that has all that currency data inside.

As a Node you can also perform what’s called Mining, where you would expend your computational power (computer’s muscles) in order to perform crazy hard cryptographic challenges. These challenges are aimed at securing the currency and at allowing new transaction to be finalized and confirmed.

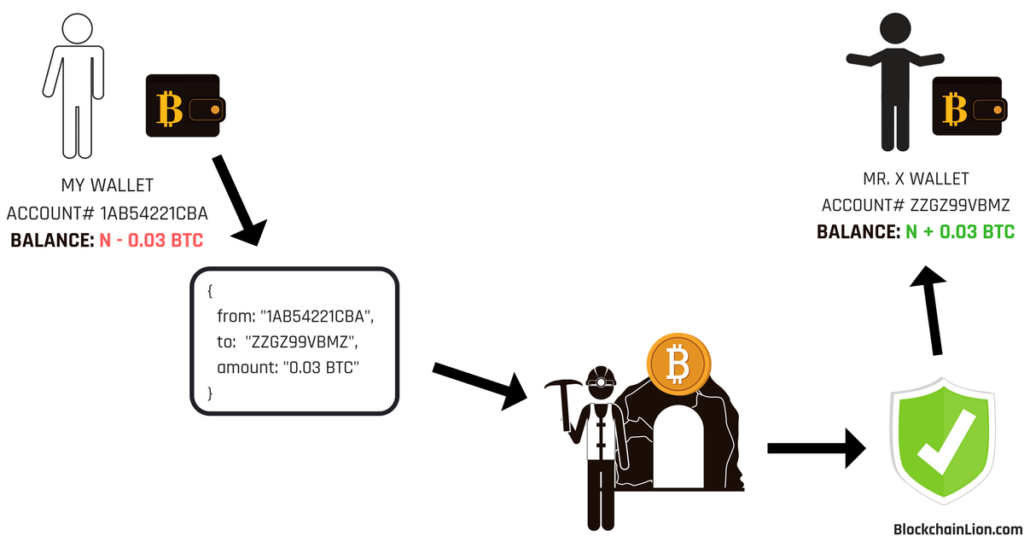

Now let’s say I want to send 0.05 bitcoins to Mr. X . I will use another type of software called “bitcoin wallet” to receive, store and send bitcoins. Bitcoin wallet softwares can be installed on your computer as programs/apps, or used on a web browser (analogous to online banking).

To send 0.05 bitcoins to mr X I will put his wallet address as a destination and create a new transaction. The wallet software takes that information immediately. It transforms it into a string of JSON code (a standard way to structure information between computers), and broadcasts it to the bitcoin network.

In the bitcoin network a miner will take that new transaction, insert it into a block, and use his computer muscles to perform cryptographic checks on it. For example, it checks if the sender has enough balance in his account. All the miners in the network compete to solve that cryptographic challenge. The first miner who “wins” gets to mine that block (full of new transactions that just happened) and add it to the blockchain.

Once the transaction has been added to a block, and the block mined, mr. X would see 0.05 bitcoins more in his wallet software’s balance, which are the ones I just sent him. I can be in Italy and mr. X can be in Australia, the transaction will be accomplished irreversibly in a matter of 20 minutes.

Miners work tirelessly to check transactions and create an immutable chain of blocks with all data about balances and who sent what. They will do this hard work because they are rewarded with transaction fees and also a bitcoin bonus whenever they win the cryptographic race and mine a new valid block.

This summarizes how the bitcoin network looks like, who are its main participants and what happens when I want to send bitcoins from a person to another.

Financial data

Let’s take a glance at the financial data of bitcoin, in particular let’s look at the trading volume of all pairs, the market capitalization and the current price.

As of today november 4th 2017, the 24hr volume of bitcoins is $2,530,760,000. The market capitalization is $124,052,190,272 , and the price of one bitcoin is currently $7444.44. [ Data from https://coinmarketcap.com/currencies/bitcoin/ ]

This gives a good overview of bitcoin without going into nasty technical details. There are many other topics to be talked about, but they will be tackled in next articles. Let’s now look at the second currency, Ethereum, and just like I did with bitcoin, I will explain the main things about this currency.

Where to buy

You can buy Bitcoins on Coinbase. If you follow this link you will earn $10 (€8) of free bitcoin when you buy or sell $100 (€85) of digital currency or more.

Ethereum (ETH)

Ethereum can be considered an evolution of the bitcoin concept. It also functions thanks to the blockchain technology so many things explained before about peer to peer networks apply here as well. But ethereum has a different type of blockchain compared to the bitcoin’s one. Ethereum not only powers a currency, but it lets you use a scripting language which enables you to build and deploy decentralized applications through smart contracts.

Let’s dive deeper, and understand how ethereum works and why it is different. I will first start with a brief history.

Ethereum was formally described in a whitepaper released by a Russian developer called Vitalik Buterin. The paper was released in late 2013. In early 2014 ethereum’s development started in Switzerland with a team composed of Vitalik Buterin, Mihai Alisie, Anthony Di Iorio, and Charles Hoskinson. The development was publicly funded by an online crowdsale, where participants could buy the ethereum tokens called ether, using bitcoin.

Several versions (also called milestones) of Ethereum were released in the following years. The first one was Olympic (version 0) released in May 2015, then Frontier (version 1) released in July 2015, then Homestead (v 2) released in march 2016 and finally the current version 3 launched in October 2017 called Metropolis vByzantium.

Each of these milestones brings new improvements to Ethereum. These improvements will tackle issues regarding security, speed of transactions, scalability, miner incentive algorithms, and other technical aspects of the currency.

The token/currency used in Ethereum is called ether and just like bitcoin is sustained by a peer to peer network of computers. It can be stored in a wallet software, purchased in cryptocurrency exchanges and sent between different entities by creating transactions and broadcasting them to the network.

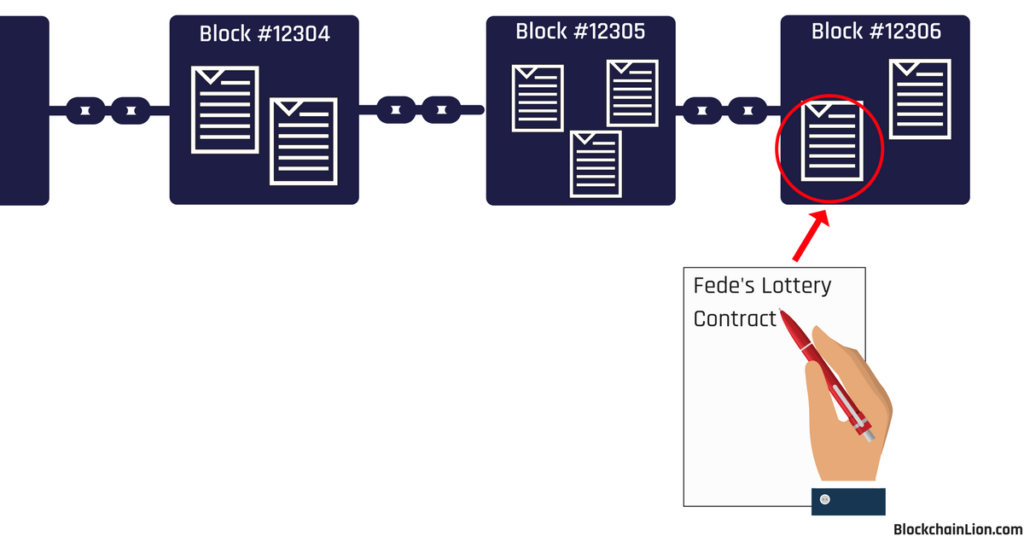

The big innovation of ethereum is smart contracts. Smart contracts are nothing more than computer programs that are publicly saved into the ethereum blockchain’s blocks. Anybody at anytime can check what a smart contract code was programmed to do.

Let’s give a concrete and very simplified example. I want to create a lottery. How can I do it using ethereum? Will it be better or worse than a traditional centralized online lottery? I’ll answer these questions in the following paragraphs.

I will start by first learning Solidity, the scripting language recognized by ethereum for powering its smart contracts. After learning solidity I will start writing the smart contract.

I will write solidity code that allows anybody with an ether wallet to send a certain participation fee to my lottery smart contract. The participation fees will be paid in ether currency. When the smart contract receives the participation fee, it will record the ethereum account that sent the fee and add him/her in the list of participants of the lottery.

I will finally program the smart contract so that after a set amount of time it will not accept participants anymore, and will pick a random participant in the list of registered accounts as the winner of the lottery. After picking a winner it will send him a prize in ether proportional to the amount of ether collected by other participants.

You might ask yourself, so what’s revolutionary here? Seems like a normal online lottery, no?

It is not a normal lottery at all. This because anybody can check if the smart contract does exactly what it claims it does. Which is especially important for this situation because you will know for sure that a participant is picked randomly.

But most importantly, once I deploy and publish my smart contract, it is saved in the publicly visible blockchain and timestamped at the moment of publishing. No matter what, nobody, (not even me!) can change it or alter any functionality. The only way to “change it” is to deploy a completely new contract in a , which will also appear timestamped in a new block at the moment of publishing.

A conventional lottery is not as transparent because a certain company will be the only entity that knows what’s going on. That company can change rules at any time, potentially allowing corruption to happen and making up rules whenever they want. And on top of that people will not be able to know what the code of the lottery software does.

So if you feel very lucky right now, and have a couple of dollars to throw into a lottery, where would you spend them? Would you participate in the transparent ethereum based lottery, or would you participate at the conventional centralized lottery? I would hands-down only trust the ethereum based one, simply because I can check the public blockchain with my own eyes and see clearly what happens behind the scenes.

This is a very shallow and simple example. Lotteries are just a game and don’t really bring benefits to humanity. But imagine applying the same principles of transparency and trust to Finance, Insurance, healthcare or any industry.

Do you see how ethereum crates a layer of security? It fosters trust by eliminating the monopoly that middle men impose on our society nowadays. This is really powerful, but there is still a lot of steps forward that the blockchain needs to do to become mainstream and mass-adopted.

I hope this section gave you a good summary of what ethereum is, and why it is different than bitcoin. Bitcoin does not allow for smart contract creation because it is only a currency. The bitcoin blockchain records transactions and balances. The ethereum blockchain records balances, transactions, but also virtual machine states and contracts written in the solidity programming language, enabling smart contract functionality as illustrated in earlier paragraphs.

Smart contracts are likely to power almost any infrastructure and process of the future, eliminating lengthy bureaucracy, expensive middle-man fees, and giving trust and power back to the users of the internet.

Financial data

Let’s take a look at the financial info of ether, particularly let’s look at the trading volume of all pairs, the market cap and the current price.

As of today november 4th 2017, the 24hr volume of ethereum is $427,713,000. The market capitalization is $28,614,024,818 , and the price per ethereum is currently at $299.54. [ Data from https://coinmarketcap.com/currencies/ethereum/ ]

Now that we know what bitcoin and ethereum are, let’s go to the third cryptocurrency mentioned earlier. It is called Ripple. What is it particular about ripple? Get ready to learn more about it!

Where to buy

You can also buy Ether on Coinbase. If you follow this link you will earn $10 (€8) of free bitcoin when you buy or sell $100 (€85) of digital currency or more.

Ripple (XRP)

Ripple was created in 2012. It was not created by a revolutionary person or group of people, but by banks and big financial institutions. It is a currency based on a private and centralized blockchain, therefore it is not decentralized and transparent as bitcoin and ethereum. This drew a lot of criticism from experts and evangelists of the major decentralized currencies.

By being based on a private centralized blockchain, Ripple is the opposite of bitcoin. So if it goes against the grain, why is it such a popular and high-volume digital currency?

The answer is simple: because Ripple has very specific use cases and has a clear place in the market. Ripple services a huge need, and we will shortly see what it is.

Let’s say I lived in the USA for a long time and I have a very good credit score. What happens if I move to another country such as France? Well France does not know about my great credit score in USA, so I will have to start from “zero” and build my credit score from scratch. This points out how difficult is to exchange information between countries since each system has very different laws and rules.

The same thing holds true in the financial world, each financial technological system has its own rules and there are massive regulatory pressures to abide. The more regulation is placed on an industry, and the more it is slow and difficult to upgrade technologies, move towards innovation and exchange information. This is why it is not uncommon to see computers and softwares from the 80s or 90s in banks or government environments.

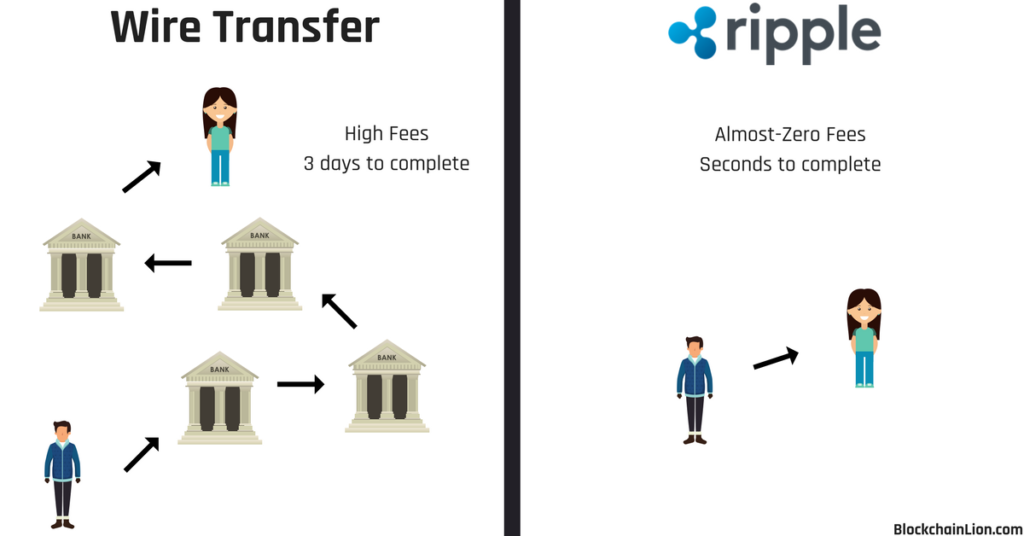

Banks do transactions between countries using a system called the Swift system. If you dissect and analyze this system you can immediately notice that it is not fully taking advantage of the technologies available today. It still relies on old infrastructure, processes and protocols.

What this results in? It results in wire transfers being very expensive because of many fees, and also lengthy, taking several days to be completed.

Ripple solves this problem by creating a common protocol, which means a common set of rules, between two institutions. Just like it is easy to transfer money from a bank of America account to another bank of America account, it is easy and instant to use Ripple to transfer money from point A to point B. Even if A and B are in different parts of the globe and are completely different institutions.

Not only this is fast, but it removes middle men and fees imposed by them. These middle men have always been there because it was thought that they were fundamental and essential to the system.

So ripple becomes the superstar of big financial institutions because it offers the chance to disrupt the swift system and speed up the transfer of international remittances. It does that without being so “anarchic” and fully decentralized like bitcoin or ethereum. Therefore making it easier for banks to still regulate the space and keep a certain degree of control over it.

Ripple is therefore made to be easily regulated, it is made to work smoothly with tax offices and being easily approachable by traditional bureaucracy.

Do you see now why this currency is essential to the market? Again, it allows to use the innovative power of instant almost-zero-fee blockchain based transfers, but also offers an easy way to comply with important traditional laws such as anti money laundering and taxation for example.

So how does a Ripple transaction work? I will now imagine that I’m sending an amount N of ripple from me to person B.

Of this amount N, a small fraction will be taken as a fee, and this fraction of coins will be destroyed to keep balance in the demand/offer of the currency. This also prevents hackers from spamming the network by making flooding attacks very expensive to achieve. The transaction is then recorded in the private blockchain, and the balances are updated accordingly.

Another notable feature of Ripple is that due to a centralized structure, it can handle a huge volume of transactions per second more easily compared to bitcoin for example. This because 70% of the ripple network is owned and controlled by financial institutions, which give more stability to the currency and highly reduce the risks of market crashes and loss of value. This means that there are not random miners like in bitcoin, but authorized institutions mining and checking transactions.

Decentralized cryptocurrencies like bitcoin, on the other hand, have a lot more fluctuations, and nobody can assure stability and control of demand/offer.

By knowing more and more about Ripple you can start to see how centralization vs decentralization is one of those dilemmas that have both very important positive and negative sides. That’s why each cryptocurrency occupies a specific spot in the market and has its specific use cases.

Again, it is very ignorant to just choose an extreme and say for example: “decentralization is best, screw centralization” or vice versa. There are big pros and cons on both sides and you just need to see what specific problem you have to solve.

Financial data

Let’s take a peek at the financial data of ripple, particularly the trading volume of all pairs, the market cap and the current price.

As of today november 4th 2017, the volume of Ripple is $77,308,700. The market capitalization is $7,853,344,137 , and the price of one ripple is currently $0.20 . [ Data from https://coinmarketcap.com/currencies/ripple/ ]

Where to buy

You can buy Ripple on Binance. Follow this link to make an account on the Binance exchange platform, the ticker symbol for Ripple is XRP.

You can also buy ripple on the HitBTC crypto exchange.

Conclusion

After this article you should have a good idea of how these three major cryptocurrencies work. There are many many more cryptocoins circulating around, but these three were present since the beginning of the blockchain technology and made a significant impact during these past years.

In the world of cryptocurrencies knowledge is power. As an average user you don’t need to know cryptography or exact technical mechanisms, but you definitely need to have a good overview of the main key concepts and how they fit together.

Now you have a solid foundation, go on and explore the possibilities of these new financial technologies.

If you have any questions, or want to say your opinion, write a comment! Would love to hear your thoughts! 🙂