In this article I will explore and discuss the Ethereum value as a project and the value of its token, the Ether.

In the next paragraphs I’ll explain what Ethereum added to Bitcoin, what it can achieve, what are dapps, decentralization and other topics that revolve around the Ethereum network, Vitalik Buterin’s creation.

The article will be concluded with a summary of ethereum’s future plans in terms of development and general goals to achieve.

Ethereum, the decentralized global computer

What exactly characterizes the Ethereum network? Why do they say that it “expanded” Bitcoin’s capabilities?

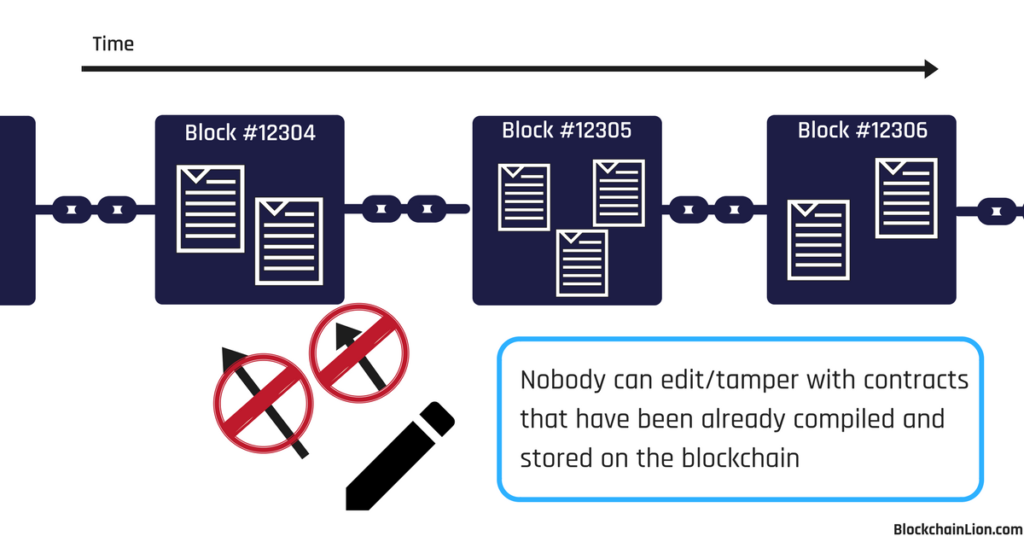

The Ethereum network is not only a decentralized (peer-to-peer) way to move the ether currency/value between two parties across the internet, it is much more. Ethereum allows “smart contracts” to be programmed and uploaded permanently into the ethereum blockchain. Anybody with an ethereum wallet can interact with a contract on the network. Also anybody can see how a smart contract exactly works/operates because it is easy to check the contract source code against the compiled bytecode on the blockchain.

Bitcoin on the other hand, only allows the transfer of currency/value between two entities across the internet, it does not allow contracts to be programmed and uploaded on the blockchain. This does not mean that Bitcoin is less valuable than Ethereum, each token serves different purposes.

So what can Ethereum achieve with these smart contracts? Virtually anything. Financial operations, insurance procedures, pay-as-you-use services, provably fair gambling, law related tasks and transparent crowdfunding are just a few of the many things that can be governed by smart contracts. When a smart contract starts governing a certain process, a new sense of transparency, fairness and trust is immediately created. This because every person that will interact with that contract will be able to read its source code, seeing exactly what is happening underneath, and know that nobody will be able to corrupt its functioning.

Nobody can corrupt or alter the contract’s functioning? Exactly, once the contract data is being mined and added in the blockchain, it cannot be deleted or modified.

To interact with a smart contract I just send directly to the contract itself some ether amount (and some optional text data) in a transaction, which will trigger the execution of specific code of the smart contract. Obviously I need to have ethers in my account (wallet) to be able to send the specific amount, which ultimately binds myself to this digital contract.

Smart contracts are written in a computer programming language called Solidity. Solidity has a syntax that is very similar to Javascript so it is an easy language to pick up, especially by web developers. This language allows everyone to program a smart contract to do everything that a turing-complete machine can do. Smart contracts can even store lists of information like a database and interact with other contracts.

So now you are ready to understand the concept of dapps. You know what is a smart contract, you know that everything happening is transparent and checkable, and you know that you interact with contracts directly using your Ether digital currency. Let’s move on to Dapps.

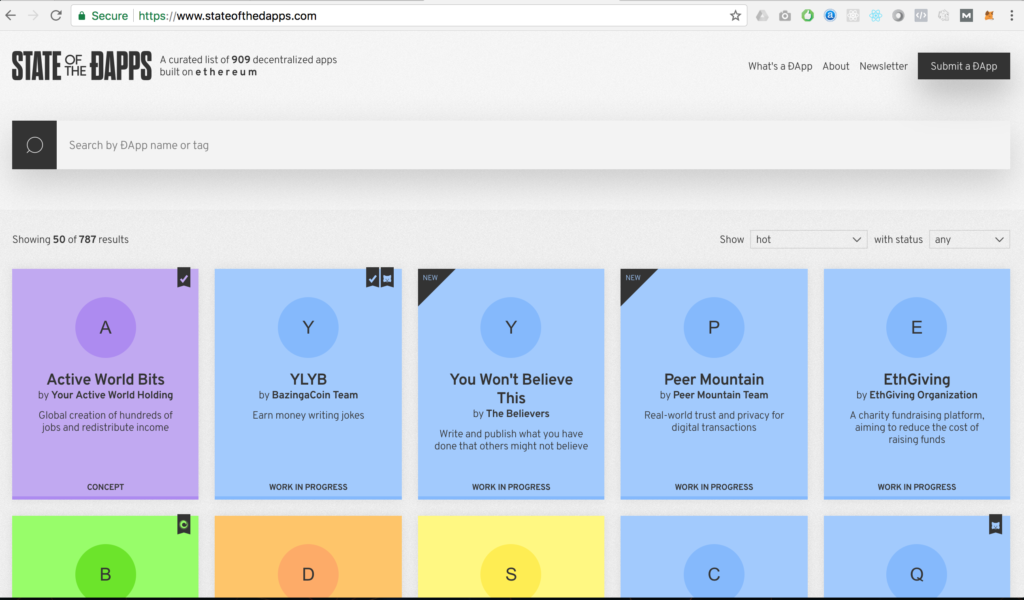

The word Dapp simply means “Decentralized App”. In Ethereum a decentralized application is built by grouping together a system of smart contracts. For example to build a decentralized social media, I will have to create a smart contract handling signup, another one handling post creation, another one dealing with friendships etc etc, you get the point.

In the past two years a high number of dapps have been created by startups all over the world on top of the Ethereum network. Each dapp is one working towards solving specific problems in areas like Government, Management, Supply Chain, Automobile, Real Estate, Music/Entertainment industry, Health Care and much more.

Remember this scenario, because it will be one of the key points for when I’ll be talking about the value of ethereum in terms of price.

As a last note on smart contract capabilities, did you know that you can even generate new cryptocurrencies (or tokens) out of Ethereum very easily? You need to program a smart contract to act as the logic of your currency. Most of the tokens you see now in exchanges like binance, cryptopia or hitBTC follow the ERC20 Token Standard and are compatible with ethereum wallets like MyEtherWallet.

With a dapp you have achieved decentralization because every intermediary will be transparent, immutable and fair with every user due to its computer-programmable nature. The contracts triggered will self-execute and self-enforce as long as you send them the required amount of Ether digital currency to support their computational expense.

I left a lot of technical details aside, such as the fact that smart contracts consume “gas” which is tied closely to Ether, or that contracts can have many different entry points (functions) and accept text data depending on the function to call, but these things are not super important to understand the value of ethereum on a macro level.

The value of Ethereum

I can now talk about ethereum in terms of value, specifically what is a unit of ether really worth?

The real truthful answer is that there is no easy way to pinpoint an exact price target, because so many different factors come into play when trying to determine it. However the value of an Ether can still be inferred indirectly, therefore in terms of benefits that it offers to its holders. Why would people buy Ether? And also, will they keep buying Ether in a recurring manner, creating a constant demand for it?

Let’s assume that in a few years there will be a global adoption of Dapps. The use of different tokens for different purposes will be mainstream and we will constantly buying and exchanging digital coins for renting cars, pay for electricity, pay for computer storage and so on. If these Dapps, or at least most of them, all are based on the ethereum blockchain, it means that every single one of these dapps is powered by Ether. Remember that you need ether to power smart contracts?

If this scenario will actually happen, then by logic we know that to keep the ethereum network alive and able to support all these projects (contracts), people will need to buy Ether constantly either directly or indirectly thru crypto exchanges. This is a good reason to support the theory of a higher price of Ether in time.

What can be another reason? Let’s forget for a moment about smart contracts and distributed computing, and let’s focus on Ether as a digital currency alone. Like bitcoin, ethereum can be just used as a store of value, and especially in the last months I’ve seen investors diversifying their portfolio almost always with Ether. This because owning Ether is a good middle ground between owning an established coin like Bitcoin and owning other super-volatile and riskier altcoins. Also the market cap of Ethereum is not too far from the market cap of Bitcoin, compared to all other coins.

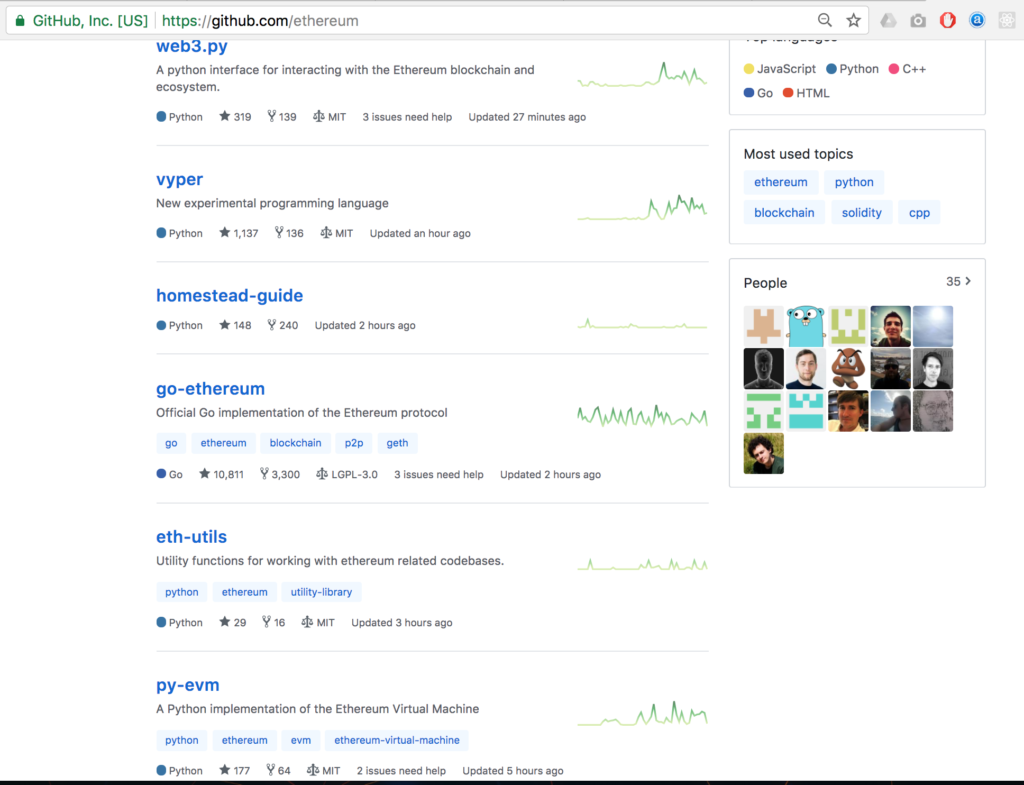

The reasons why we could see a lower Ether price in the future are mostly related to failure to scale the technology properly, bad publicity in the press due to a major software vulnerability or hack, or a competitor building a better smart contract platform. These are all rare occasions because of the hard work that Vitalik and its team put in every day. Just by following conferences and technical speeches you can tell that the core team behind Ethereum is extremely technical and motivated to progress the software more and more. Don’t believe me? Here is a screenshot of ethereum’s Github repository, new code is being pushed to their mail projects on a hourly basis.

Future plans for ethereum

What is the future of Ethereum, what is the roadmap, and what about the next improvements? Let’s find out!

Vitalik Buterin, the inventor of Ethereum, spoke recently (in Nov 25th) at the BeyondBlock Taipei 2017. At the conference he talked about the next improvements that Ethereum is planning to achieve as a technology. These areas of the codebase that will be improved are safety, privacy and scalability.

At the beginning of the talk he has a slide up in the screen saying “What do we mean by Ethereum 2.0?”. He says with sarcasm, “well I think the answer is pretty obvious” and proceeds with the next slide, which shows the logo of EOS (EOS is an alternative cryptocurrency that is commonly referred as the better ethereum, or ethereum killer). Vitalik and the audience start laughing for a bit, then he goes on with the next slide, which says “Umm… no. I said Ethereum 2.0”.

After these sarcastic slides he takes the microphone and says “look, the Ethereum killer is Ethereum, the Ethereum of China is Ethereum, the Ethereum of Taiwan is Ethereum [pauses for a few seconds] 2.0.

Why did I highlight this brief part of the talk?

Simply because it shows the motivation that one of the main leaders (developers) of Ethereum have. The Ethereum foundation wants to progress, beat the competition, and become a true technology that will change the world. In fact, the rest of Vitalik’s talk was extremely technical and detailed, with concrete strategies to scale more and tackle every problem that Ethereum is now experiencing.

Most of the best tokens out in the exchanges now are only able to achieve two out of three prominent features of digital currencies, which are decentralization, scalability and security. Ethereum is exactly trying to deploy a currency software with all three features.

Let’s quickly look at the main improvements.

Scalability

In the area of scalability, Vitalik gives a clear measurable goal to achieve: a thousand of transactions per second. It is an important goal because it is the number of transactions that Visa and Mastercard can process per second. If Ethereum can achieve this performance/scalability goal, it will prove that the Ethereum network can power transactions as fast as a traditional payment system.

If you are curious about how this performance can be achieved, you have to look into Sharding. During the talk Vitalik describes in detail how the blockchain can be divided in smaller components (called Shards), each processing transactions in parallel.

Separate experiments will be run along the main ethereum network to test the effectiveness of Sharding.

Privacy

In the area of Privacy, there will be an implementation of zk-Snarks (zero knowledge proofs), which allow application creators to make sure there is tighter privacy. An example would be being able to hide transactions from the public view, but also being able to show them to specific parties of the user’s choice.

Zk-Snarks are a complex topic to understand, you need to be able to read computer science academic-level papers to understand its inner math and cryptography-based mechanism.

Consensus Safety

All nodes in the network reach consensus thanks to miners. The way consensus has always been reached both in bitcoin and ethereum, was by having miners use a proof of work (PoW) algorithm to validate blocks. PoW requires miners to mine a block by solving lengthy and expensive cryptographic challenges in order to obtain to a unique solution consisting of a string of letters and numbers. That string of text is used right away by other miners check that the miner that solved the challenge actually did solve it, and successfully give him the network reward a block of transactions. Each block of transactions is mined using this algorithm.

With proof of work electrical energy is heavily used to mine blocks and build the blockchain. This report (https://powercompare.co.uk/bitcoin/) shows that bitcoin, consumed in a year more electricity than 159 countries did. Vitalik admitted that Ethereum’s situation is not too different. Therefore Ethereum is planning to switch to a different and less energy consuming mining algorithm, Proof of Stake (PoS).

With proof of stake Ethereum network participants would stake their Ether tokens in order to validate transactions by taking turns in proposing and voting on next blocks. The incentive to not cheat is that if you do happen to be dishonest and go against the network, you will lose all your Ether tokens staked to participate at the beginning. If you do not cheat and vote/propose correctly to validate blocks, you will gain a reward in Ether proportional to how much you are staking.

This consensus algorithm is praised by the Ethereum team as a more energy efficient, and brings improvements in terms of security and reduced risk of centralization. In fact, the famous 51% attack on a blockchain network, is a lot more expensive and unachievable in a PoS algorithm.

Smart Contract Safety

We saw earlier that Smart Contracts are code that runs on a turing-complete machine, meaning it can achieve most of the things that any other computer software can achieve. This was the main innovation of Ethereum and many applications have been finding countless uses and moved big amounts of money around.

The problem is that turing-complete machines can be exploited by injecting malicious inputs on vulnerable software, running code that can be manipulated by expert attackers. So just like an attacker can hack a webserver and access precious data, another attacker can hack Ethereum smart contracts and steal all of the contract’s funds. Irreversibly.

The most known ethereum security flaw was the DAO hack. The DAO was a Decentralized Autonomous Organization that had the goal of organizing both commercial and non-profit enterprises. In June 2016 attackers exploited a vulnerable piece of the DAO smart contract code and stole something like 50 million US dollars from the investors of the DAO’s last crowdsale. The Ethereum foundation made a fork in the blockchain history in order to revert that theft, and the blockchains split in two, creating a clone currency, “Ethereum Classic”.

It was a rough period for the Ethereum foundation, and it really brought to the attention of everyone the importance of writing secure code, and having security mechanisms built in the Solidity language.

Vitalik said in the Taipei conference that formal verification will be introduced for smart contracts, and that a new Python-like language named Viper is being developed. Viper will make it easier for developers to create safer ethereum applications.

How to buy Ethereum tokens

You can buy Ether on Coinbase. If you follow this link you will earn $10 (€8) of free bitcoin (not ether, but you can exchange that immediately) when you buy or sell $100 (€85) of digital currency or more on Coinbase.

Ether can be also bought on the Binance, cryptopia or hitBTC cryptocurrency exchanges.

Conclusion

These are the main topics in my opinion that really help define Ethereum’s value and potential. What do you think is the value of Ethereum? Do you have any questions or something is unclear? Leave a comment below!