In this article we are going to talk about Cardano, a third generation crypto token. Why third generation? What are exactly the first and second generations? These questions will be answered right from the start.

Then I’ll explain what are the three main problems that the first two generation of tokens faced, and how Cardano wants to solve them as a true third generation token. There will be three sections that will describe Cardano’s approach to each problem in detail.

If you don’t understand the specific technical lingo don’t worry, keep reading and focus on the summarized broad concepts and the big picture.

Three generations of tokens

blockchain-based cryptocurrencies/tokens can be divided in three main generations. The first one comprising Bitcoin and other early cryptocurrencies, the second one defined mainly by ethereum and smart contract tokens, and the third one being the newest wave of currencies, where Cardano belongs. Let’s give a quick look in detail.

First generation Tokens

The first generation tokens were created to solve only one main issue: creating decentralized money. What the creators of these digital currencies wanted to achieve was the transfer of value from a party to another one, without needing a centralized intermediary.

Therefore Bitcoin made transactions possible in a peer-to-peer fashion, where no party needs to know and trust anyone else, as long as everyone agrees upon the main protocol.

This concept is amazing, but it does not expand in scenarios where we need more “control” of our transactions. For example we cannot say “I pay you 0.02 bitcoins if and only if you paint my wall” or “I pay you 0.1 bitcoins only if my car is ready for pickup at 4:00pm”. This cannot be done in the Bitcoin network without creating another cryptocurrency, or cloning the code of bitcoin creating a different variant that sustains contracts.

This is why a second generation of cryptocurrencies came up around 2014.

Second generation Tokens

By second generation token I mostly mean Ethereum. Ethereum brought to blockchain what javascript brought to the browser. Therefore just like javascript turned the browser into a dynamic platform where Facebook, Youtube, and other highly engaging platforms could be built, Ethereum turns the blockchain into an infrastructure that can host more than simple currency transactions.

From a static and simple collection of records, the blockchain became envisioned as a way to store coded programs. These coded programs can represent contracts, with clauses and conditions that will be transparent and visible to all participants.

When a participant sends a transaction to one of these blockchain contracts, the conditions and clauses that the participants agreed beforehand will auto-enforce, guaranteeing trust and transparency.

Seems brilliant! I don’t see anything wrong with this, why do we even need a third generation of tokens?

Well, underlying technical problems arose in the areas of Scalability, Interoperability and Sustainability. Third generation tokens aim to solve these problems.

Third generation tokens

Third generation tokens have a really tough job to accomplish. They need to expand the innovations brought by previous generation tokens, and at the same time solve critical problems that also arose in the past.

The main problem to solve for this third gen. tokens is scalability. Scalability is a big word and it can be broken down in three components: transactions per second, network resources and data scale.

Transactions per second is pretty self-explanatory, it indicates how many succesfully valid transactions can be performed in one second. Bitcoin supports 7 transactions per second, while Ethereum supports 10-14 transactions per second. This parameter looks very important and every newer token advertises their ability to support hundreds of transactions per second, but it is not nearly as important as the second part of scalability: the network resources.

Network resources are a much more important element of scalability. Since transactions contain data inside, the network needs to have enough bandwidth to securely transfer these transactions from node to node across the whole network fast. So you can have a token with an algorithm that can theoretically support 1000 transactions per second, but if its network is not designed and built with enough bandwidth available, it will congest when millions of users start transacting.

The third component of scalability that I mentioned earlier was data scale. By this I mean the act of storing the whole blockchain into computers that “mine” or participate in a token’s network recordkeeping. The blockchain with time gets heavier and heavier so there needs to be a way to store it efficiently.

A project that aims to elegantly solve all of the problems that first and second generation tokens have is the Cardano project.

Cardano token

I will explain how Cardano will tackle the issues of scalability, interoperability and sustainability.

Scalability

Cardano is one of the few projects that has a team that thinks, plans and operates in a very scientific way. In fact every single one of their main features is written as an academic research paper, which is then peer reviewed for accuracy and error-checking.

Cardano’s engineering team developed a provably secure proof of stake algorithm to power its own kind of blockchain. This algorithm is called Ouroboros.

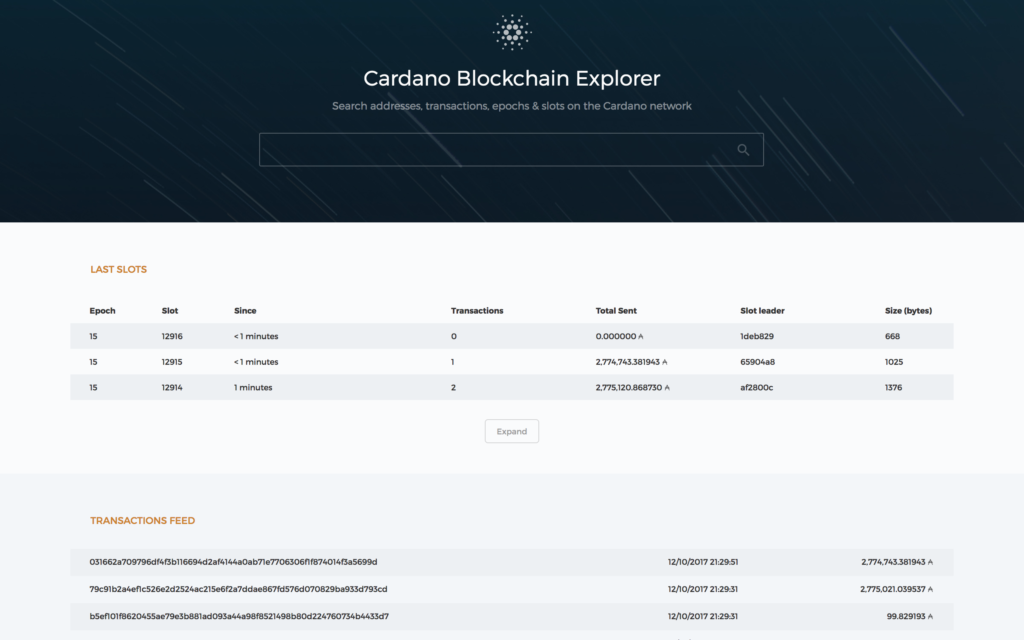

Ouroboros breaks data into epochs, it looks at the token distribution in the network and from random numbers it creates “slot leaders” inside every epoch. This is the process that allows the Cardano protocol to discover a block, just like bitcoin discovers a block using proof of work computational algorithms. The main difference between the block discovery in Bitcoin vs Cardano is that Cardano’s block discovery algo requires less computation power, which means it is cheaper to run on node computers, while being as secure as bitcoin’s block discovery process.

Breaking epochs into small slot leaders means that Cardano can maintain many chains of blocks for each slot, creating a consensus among groups of chains instead of a single chain.

Security is also a priority for Ouroboros, which uses quantum resistant signatures in its protocols. The conceptual design of Ouroboros has been peer reviewed and approved at crypto17 this year, which is the 37th International Cryptology Conference.

How is Cardano going to tackle the third issue of scalability, data scaling? It is going to solve it with a mix of pruning, subscriptions, compression and partitioning. These techniques will be used by nodes to be able to verify transactions just if they have the whole copy of the blockchain, but without having to store it completely. Also sidechains will be heavily used to achieve this.

So in these paragraphs we just saw how Cardano will tackle scalability as soon as more and more people will join the Cardano ecosystem and the transactions per second will increase. We saw how the network stack will handle high throughput, and how the stored blockchain data will be handled.

interoperability

Interoperability is one of the problems that first and second generation tokens have. Interoperability is the ability for different tokens, cryptocurrencies and legacy systems to talk and understand each other. By legacy system I mean for example the traditional and current banking infrastructure such as SWIFT, by other cryptocurrencies I mean for example bitcoin, ethereum, ripple etc etc.

Right now the only way for currencies to talk and exchange value with each other is with a cryptocurrency exchange such as Coinbase, Bittrex, etc… Therefore exchanges dictate the movement of value. Do you see the problem here? Exchanges are also a very fragile point in this system, they are centralized and can be hacked, or shut down due to wise or unwise regulatory pressures in their countries.

Why did I mention legacy systems? Well, because for example what is happening currently is that a company raises 10 million dollars in Ether during an ICO crowdsale, and when the time comes for the company to change these Ethers into dollars and putting them into a bank account, the bank starts asking questions due to its strict financial regulations. The questions will be, for example, where did you get these funds? Who were these investors?

The company that just finished the ICO will answer that the money come from a crowdfund from people on the internet. The bank will immediately label everything as a high risk environment and maybe even put restrictions on these funds, depending on the jurisdiction.

Now you can see how interoperability becomes also a fundamental issue to tackle for tokens like Cardano.

A third generation token like Cardano, to nail a great interoperability, needs to find two main solutions: firstly, a way that allows tokens right now to exchange value with each other without relying on centralized exchanges to bring them together. Secondly, a way that allows cryptocurrencies to finally talk to banks and integrate in our current traditional banking system.

To achieve relationship and communication between cryptocurrencies and other blockchains the main strategy is to use a sidechain. This way currencies know about each other’s history and ownership without needing to posses the other currency’s blockchain entirely.

Achieving communication and interoperability with traditional banks is a whole another big challenge. The Cardano team figured that to realize this goal there needs to be a mix of three components: metadata, attribution and compliance. Metadata means being able to send a story attached to a transaction, it has to be done without exposing sensitive data. Attribution means identification of who is involved in a transaction, which can be a subset of metadata. Compliance will be something absolutely essential, because in order to transact with our traditional financial world there needs to be a rigorous compliance with at least KYC (Know Your Customer), AML (Anti Money Laundering) and ATF (Anti Terrorist Funding) laws.

Sustainability

Sustainability is the third pillar of third generation tokens, In this section I will outline how Cardano envisions optimal and fair sustainability.

First let’s define a bit sustainability in the crypto space.

Sustainability essentially comprises three things, which are how users pay for the mainteinance of the network/token, how all aspects of the development of the network/token get prioritized, and how infrastructural decisions are made. Let’s go over all three of them.

In terms of how the development is paid for, we saw historically two models of keeping a cryptocurrency funded, the volunteering of one or more corporations to sustain development efforts, and the ICO model. These models are not perfect, because in the first case a certain corporation is likely going to have more influence on technical decisions than the community. In the case of crowdfunded token sales, you might have already realized that ICOs are simply quick jolts of energy, where a certain sum of money is earned and eventually all spent without further guarantee of future funding.

Cardano aims to improve this first aspect of sustainability by issuing a decentralized treasury and an improvement-planning system. In fact this touches also the second aspect of sustainability, which is how all aspects of the development of the network/token get prioritized before getting the funds.

This treasury will allow users of the network to submit improvement ballots, which are then voted by the community to decide if they should be executed or not and with what urgency/priority. For example Bob submits a ballot that outlines a series of marketing operations, while Alice submits a ballot with a series of technical/development improvements. These two ballots will be then shown to the community, which will vote on which one is more important and should be executed right now. Everything is designed to be done in a decentralized way, and it was inspired by the Dash cryptocurrency and their model of treasury.

The third and final aspect of sustainability is the ability of making core decisions about the internal token protocol and infrastructure. Do you remember the bitcoin and ethereum hard and soft forks? That’s exactly what a 3rd generation token like Cardano wants to avoid. Just like if a country changes a rule in the constitution, there should not be two different populations as a result, but a single one that universally agreed in that rule change.

Cardano’s core decision system will also be based on the treasury model, where a special ballot will indicate what changes need to be done in the network’s protocol or in the nodes’ core software. A huge leap that the Cardano team is planning is the ability to write improvement ballots in a machine-understandeable way, so that when a specific ballot wins, it is auto-implemented since the protocol itself understands the ballot on a machine-to-machine level.

Again the goal here is to avoid forks that split the blockchain in two parts and create two different tokens. This ballot system avoids this by creating a universal consensus in the community with decentralized and very importantly, incentivized voting.

How to buy Cardano tokens

If you want to buy some Cardano Tokens you can go to Binance. The ticker name for Cardano is ADA. I bought them myself for supporting the project, and knowing that their price will go up if the development is successful.

Conclusion

I really enjoyed writing this article while researching and learning more about Cardano. It seems an ambitious project that has a very scientific and academic way to plan and execute its development and deployment.

One of the main guys behind Cardano, Charles Hoskinson, was one of the co-founders and developers of Ethereum. This means he has seen the technical aspects of second generation currencies and lived in first person the creation of Ethereum, a second generation token. He committed until 2020 to the Cardano project and is doing an amazing job creating content to educate the people about Cardano.

In summary, you learned what the three generations of crypto tokens are. You learned there are three main issues that the first two generations of tokens face, which are scalability, interoperability and sustainability. Then you saw in detail how Cardano, a third generation token, goes about solving these three issues.

What do you think about Cardano? What other aspects of this project amaze you? Will it beat the competition? Please leave a comment!