In this article I will talk about Initial Coin Offerings again, but this time from an investor point of view. I precisely aim at showing you what is my process when planning an ICO investment.

I will illustrate how I usually do research and evaluations in order to decide if I should participate into a particular crowdsale or not.

DISCLAIMER:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, or suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

I will start by emphasizing why knowledge in this crypto and ico universe is so important, then why should anyone be interested into participating in icos.

After that I am going to illustrate that investing in an ico is basically investing in ideas, and how it can be a gamble if not done properly.

A few resources to check all upcoming ICOs will be provided also.

In the last section I will then show what I keep in mind every time I do research on upcoming ICOs of blockchain startups. This will include looking at websites, whitepapers, competitors, team and most importantly the software/technical analysis.

By the end of this article you will have learned some good applicable concepts. These will make you a more educated person in the blockchain startups world. You will have better knowledge than most of the ICO investors out there and you will be able to avoid scam ICOs.

Remember that nothing is 100% sure in the startup world, always invest what you can comfortably afford to lose.

An ICO investment? What do you mean?

If you are in this website, chances are you want to know more about the cryptocurrencies and blockchain world. You are in the right place 😉 . It is a very new and complicated universe, where regulation is missing and nobody is there to hold your hands. The average person in this space is still trying to grasp the basics and connecting the dots together.

In this crypto world specific knowledge is essential to understand what’s going on and how not to lose money, energy and time.

Without specific knowledge, you will be naturally comparing digital currencies and blockchain concepts to regular fiat currencies (the dollar, euro, yen, etc) and traditional finance concepts. This is a sure way to make mistakes because nothing about crypto comes from traditional foundations that we have already seen in the past.

Why do I say this? Because there has never been a blockchain database built before, there has never been a decentralized digital currency before. But on the flipside, stocks, equities, real estate and traditional assets have been around since ancient times.

A good example is the price valuation of digital currencies and tokens. If a non-crypto-educated person sees the 24hr price variations of these cryptocoins he will immediately freak out.

Why will he freak out? Because he will see a -16% loss of valuation for a particular cryptocoin, and will immediately think that something really bad is happening. He or she might think that there is a huge technical problem in the network, or a big scandal or fraud was discovered, or that some other big negative episode happened. This will lead to a high skepticism and distrust in the ecosystem, which in turn leads to that person spreading negative information to other people.

This because traditional financial assets never drop in price in the order of such magnitude.

On the other hand, what a knowledgeable person sees is a normal variation of price for the cryptomarket. He also knows how volatile and dynamic these currencies can be. Therefore he will keep browsing the valuations page without being affected by negative thoughts at all. He is calm, believes that the technology behind these coins is very strong, and sees a long term potential.

This is what I mean by being knowledgeable in the crypto world. First you educate yourself about the technologies, get to know the ecosystem and then you make solid decisions about your involvement in it.

So now that you know why knowledge is especially important, let’s start going into the main topic, which is investing in Initial Coin Offerings. I am assuming that you know what an ICO is and how it works. (I wrote all you need to know about ICOs here: https://blockchainlion.com/initial-coin-offering-101/ )

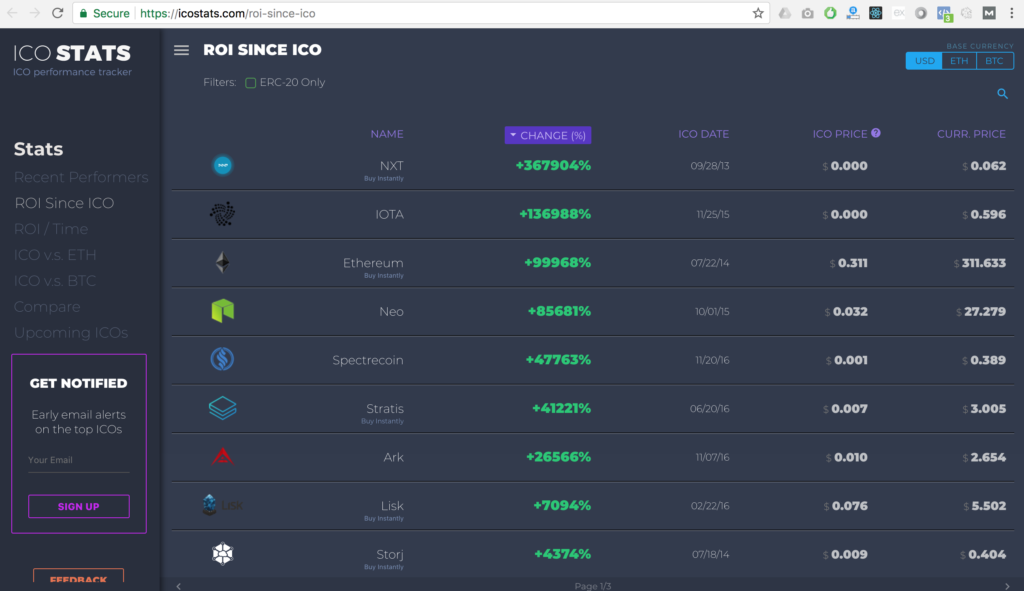

So why would I even remotely consider doing an ico investment? Well I have a picture that is worth a thousand words, just look at this screenshot I took:

Have you seen these ROIs??

If, for example, you would have participated at the Ethereum crowdsale in 2014 you could have bought 100 ether for $311. These coins would have now been worth $331,633.00. Not bad at all.

The problem is that as time goes by, and especially now while you are reading this article, the number of ICOs grew exponentially. There were a few ones in 2014 and 2015. There were 46 ICOs in 2016 that raised a total of 96,389,917 USD. Then in 2017 we have 203 ICOs that so far raised a total of 3,256,704,359 USD (without counting November and December).

So just like many things, if you jumped in that niche at the beginning you could pretty much invest in any random ICOs and find a great ROI. But now, with this astonishing amount of ICOs you cannot just throw money at random crowdsales and hope to get a high return.

Let me repeat this again: it’s 2017! there are hundreds of ICOs running this and next year. You need to be a smart investor if you want to succeed. And by smart I simply mean that you need to have a process that allows you to pick startups with the best odds of success.

If you just throw your money at random ICOs without doing any research, you are straight up gambling.

So what does being an “ICO investor” even mean? Simply put, it means that you are investing in ideas. Most of the companies that are doing an ICO are not yet developed, they are looking for funds to start.

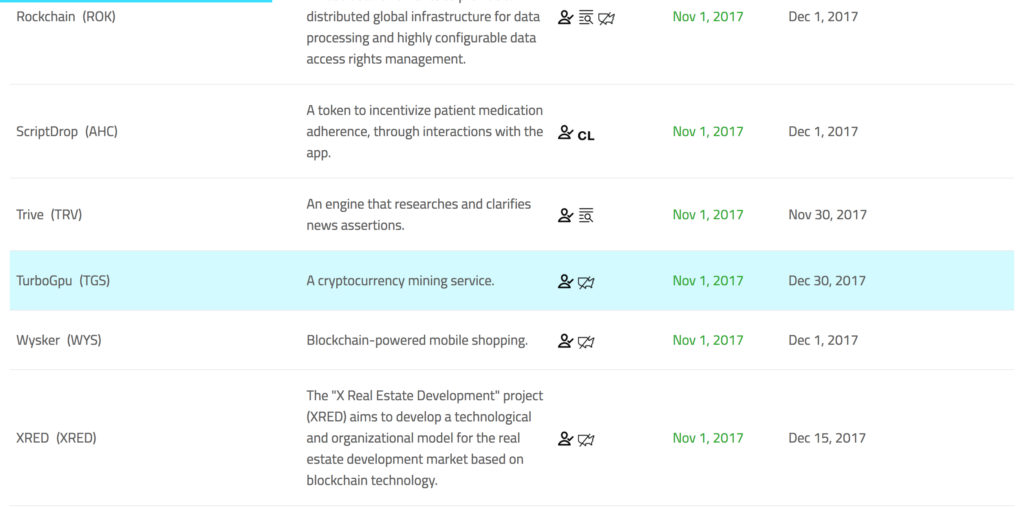

You might be asking yourself, where the hell do I find these ICOs?

Here are a couple of websites I use to see the current and upcoming crowdsales:

– https://www.smithandcrown.com/icos/

– https://icowatchlist.com/

There are a few more, but they all do the same thing. Among the two that I listed, I like Smith And Crown more because they seem to be a bit more selective with what they include in their website.

Now you have a list of ICOs. Do you notice how many there are? A lot! And they all focus on a specific vertical, covering almost every service or industry of modern society.

In the following section I will outline a simple research process that I use when looking at ICOs. I use this to understand the startup from almost every facet and point of view. This research process allows me to give a rough valuation of the startup’s idea and its team’s vision. After doing this analysis I can tell if it’s worth investing or not.

Remember that there is no such thing as a perfect research process that picks winner ICOs every time. A startup can look amazing under every aspect, but still encounter unpredictable obstacles and collapse.

ICO Dissection Process

Let’s get started with the research phase! I will be a bit abstract here, without referring to any specific ICO, so you can take this as a blueprint and apply it to any ICO you decide to research.

Website

The first thing to do obviously will be to look at the company’s website. Chances are their website will look amazing and you will think: “wow! these guys really rock! I should totally invest in this!”. Well the truth is, every ICO website looks amazing. So it is not a reliable predictor of the company’s success.

Scroll through the website and read their claims, their explanations and FAQ but do not look at the whitepaper yet. If by the end of your website scouting you understood pretty well what the company is all about, chances are their marketing team is pretty strong. This is a great thing because it means they have the skills that allow them communicate their value and vision effectively.

You have barely scratched the surface. You now know what industry they are in, what do they want to achieve, the basics of their product and you saw their team. It is time to dive deeper.

Whitepaper

The website should point somewhere to their whitepaper. Some companies have two types of whitepaper, a non-technical one and a technical one. If they do, start obviously with the non-technical one, which will give you an overview on their product/service.

Read the whitepaper carefully. Very carefully. It should be logical, and it should walk you through every aspect of their product/service. After reading the whitepaper you should have a 360 degree view of their product and you should know why it is going to positively impact the industry they are in.

If something is confusing, if they jump from one topic to another or if some particular feature is not well explained, that is a red flag. I have seen scammers putting together horrible whitepapers with spelling mistakes, and with explanations that were incomplete or not connected with the main topics.

Team

Time to look at the humans behind the ICO. They are usually listed on the website, along with their role and contact info.

Like an investigator, you should follow each trail and google their names to find out as much as you can about them. Look at their past involvements, their skills, their records and anything you can find online.

Be very careful, scammers will pick random photos of devs and founders from websites like http://uifaces.com/ in order to create a fake team. They will even link to some existing github pages or facebook profiles, to make the whole thing seem more realistic. Sometimes people are even added to a team or to an advisor board without them even knowing about it.

So how can you spot the scam? The best thing to do is to look for actual videos where these people talk about their project. Also look for appearances in conferences or meet-ups. If you can find a video of a conference where one of the ICO team member gives a speech about their vision, you ca be sure that these guys are working hard to bring their idea out there.

Competitors

Look at the competition. Research that specific area and try to see if there are other ICOs. Two cases are possible: you find nobody else doing an ICO in that business vertical, or you find a few more ICOs.

if you don’t find any ICO either that startup is a true pioneer in the industry, or the idea of putting tokens and blockchain in that area is so absurd that only a scam artist would place an ICO there.

In the event that you find other ICOs in the same area, then you have some further research to do. This is usually the case with financial services and products. There are many ICOs that claim, for example, that they will build the fastest and zero-fee platform for trading stocks. This because blockchain has a lot of direct financial applications.

So research each individual competitor ICO, compare the team, the product, the whitepaper, and try to understand who is achieving that objective more efficiently. Especially the technical whitepaper can be the tiebreaker.

Once you have a good idea of the competition, you can move forward to the community based research.

Community and social

Here we will go through the process of looking at the community engagement of the ICO team.

Every good ICO has to have live chat rooms where people can engage with the team and ask questions. Usually Slack or Telegram are used. It would be a good idea to join at least one of these real-time chat rooms and ask questions directly to the ICO team members. Especially if you did not understand something in the whitepaper or have concerns about the competitors’ technologies.

Another place to check is the bitcointalk.org forum. The ICO team should have a designated thread in which they answer questions and keep the community updated. Bitcointalk is the oldest and one of the most established cryptocurrencies forums out there. One thing I recently discovered is that scammers will buy forum accounts with good history and reputation. They will then use these accounts to auto-comment their thread and spread fake optimism about their project.

So exercise your intuition muscles and try to understand if the team is actually putting themselves out there to address any question and concern. The more involvement you see, such as slack channel participation, conference speeches, meetups, youtube videos or personal blogs, and the more you can be sure this team can be trusted with your contribution.

Software Analysis

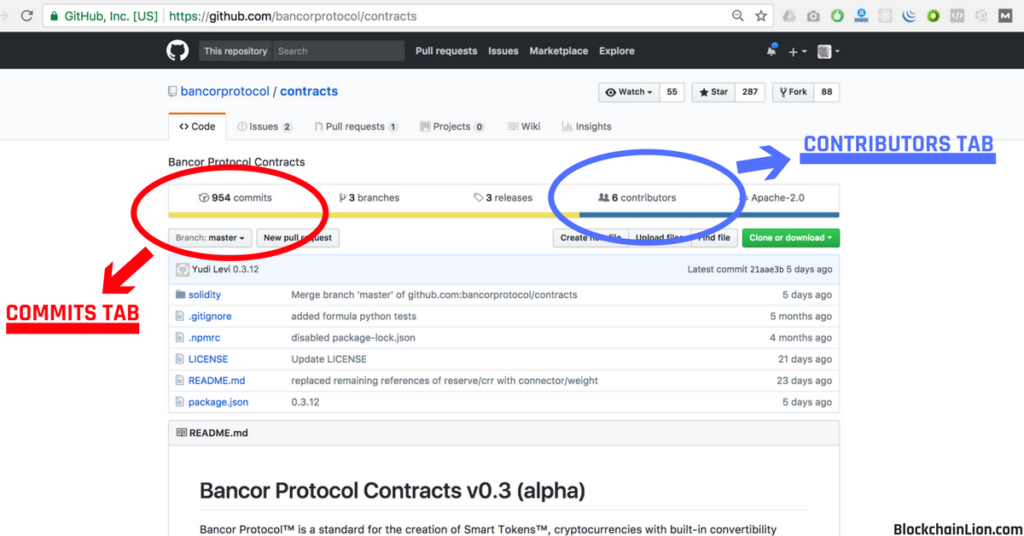

This is the most important part: the technical aspect of the ICO project. For this you will need to see if the startup has a Github repository for their project.

Github is a fundamental tool for software developers. It allows any developer to upload every kind of code they are working on into a public web-based repository. Github works thanks to a software that runs inside every developer’s computer called Git. When I start coding up a project I will make sure to save my progress every once in a while by telling Git to upload my files to a particular Github repository on the cloud. If my computer suddenly gets destroyed or starts to malfunction, I do not lose progress because all the files I’m working on are constantly uploaded to Github.

In fact every person can go to a public Github repository and see, read or even download the files I am working on. If tomorrow I modify some files and write more code it will be reflected in the github page as a new “commit”. A project is made by a history of many commits, where each commit is an addition of new code or new files. The reason why keeping a history of commits is important is because if I screw up the whole program with a coding mistake, I can revert back to a previous commit and start again.

An example of a github page would be the official bitcoin code repository, which you can see at https://github.com/bitcoin/bitcoin . This repository has more than 15 thousand commits.

Why did I start talking about Git and Github? Let me now connect this to the ICO investment process.

If the ICO you are looking at has a Github page, it is a good sign because it means that they are actually starting to develop their product. Be careful that just having a github page is not enough. You need to dig a little bit deep and see how many commits have been made. A high number of commits may indicate that the developers are working really hard (good sign) or that they just cloned another github repository with many commits (bad sign). You can learn more about a project’s commits by clicking on the “commits” tab at the second-top menu. Also check the frequency of the commits, a high frequency indicates that the code is being constantly improved.

Another super important thing to look at are the contributors of the code repository. By clicking to the “contributors” tab you can see how many people are writing and committing code to build the project. You can also see with what frequency they are doing so.

Github analysis might seem difficult and confusing at the beginning, but it is one of the best predictors of an ICO’s success. The teams that start building their product early, and show that they have passionate developers contributing code, are the teams that are making the best use of their funding. Please learn Github’s basics and spend time researching ICO’s code repositories.

Another important thing to look in the github page is the smart contract code. Smart contracts are the heart of an ethereum-based blockchain ICO. The smart contract file extensions end with “.sol” meaning they contain code in the Solidity programming language syntax. I strongly suggest you to copy the smart contract code and paste it into http://securify.ch/ . This website will check the smart contract’s solidity code security and identify its potential vulnerabilities.

How to buy cryptocurrency

To participate in an ICO you will need to have some bitcoins or ethers ready. You can buy cryptocurrencies by transferring your fiat currency to Coinbase and exchange it for bitcoin, ethereum or Litecoin. Use this link to get a 10 USD (8 EUR) bonus in bitcoin when purchasing 100 dollars (80 EUR) or more in cryptocurrencies.

Post-ICO tokens are sold/bought in crypto exchanges like binance, cryptopia or HitBTC. You can make an account in these exchanges, and then use it to purchase any ICO token that you want.

Conclusion

in conclusion, I gave you a series of important concepts to pay attention to when deciding to invest in Initial Coin Offerings.

Always always always keep in mind that the cryptocurrency world in this present time is the El Dorado for scam artists.

Only believe in the ICOs that have motivated and passionate humans behind them. And remember that not every ICO will be successful. Use these tips as a starting strategy and dig deep into every detail you can. The more time you spend on an ICO, the more you are minimizing your risk of losing your investment.

What do you guys think? Am I missing any important step? Is your ICO research and investment process different? Please leave a comment, I would love to hear anyone’s opinion.