In this article I will talk thoroughly about the concept of ICO, which stand for Initial Coin Offering. In particular I will explain what an ICO is, how does it work and provide some examples and numbers.

I will also briefly compare it to the more traditional and known concept of IPOs, and point out why ICOs are a revolutionary way to raise capital for startups.

Finally I will draw a parallelism with the dotcom bubble of the 90s, and another one with the boom of car manufacturers.

By the end of this article you will know what an initial coin offering actually is, and what are its strengths and weaknesses. You will also be able to compare this moment in history with previous ones and outline what is different and what is not.

Initial Coin Offering 101 – The basics

An Initial coin offering (also called ICO, or token crowdsale) is a mean of crowdfunding using cryptocurrency, with the goal of raising capital for a particular company. Investors will give legal tender or cryptocurrencies such as Ethereum or Bitcoin in exchange for that company’s newly generated tokens or cryptocoins.

The company that launched the ICO will later issue tokens to the investors as a proof of participation in the crowdsale. These tokens can represent right of ownership or royalties to the project, like digital stock certificates. These tokens also might or might not be used later to access features of the company’s platform/product.

It is similar in concept to an IPO (initial public offering), where a company goes from private to public and allows investors to buy newly issued shares. But in reality it is very different: a company doing an IPO is usually looking to scale and it is already offering a product and earning revenue. On the other hand a company doing an initial coin offering is usually at its starting stage, looking for capital to launch its product.

So let’s make a concrete example about this concept of initial coin offering (ICO). Let’s say I am the founder of XYZZ LLC, a cool disruptive tech startup with a clear roadmap and a strong vision. I need to raise capital to build and launch my product. Instead of presenting myself to venture capital firms or angel investors I decide to raise money with an initial coin offering.

I will announce to the internet that during a set period of time it will be possible to send XYZZ any amount of bitcoins or ethereum currency in exchange for XYZZ tokens. When that time comes, investors that believe in my company’s vision will contribute with their digital currencies, giving me the capital to fund my idea.

Some time after the end of the crowd sale, they will receive back in their digital wallets the XYZZ tokens proportionally to the amount they contributed. These coins/tokens will appreciate in value if the business is successful.

To give you some numbers on how powerful ICOs can be, let’s make some real life examples. One of the first famous ICOs was Ethereum. Ethereum launched his platform with a crowdsale in 2014. They raised 3700 bitcoins in their first 12 hours, which were equal to approximately 2.3 million dollars at the time. The ethereum tokens, called ether were sold for a price of 0.40 USD per ether. Now as of November 9th 2017, they are valued at a price of 325.30 USD per ether.

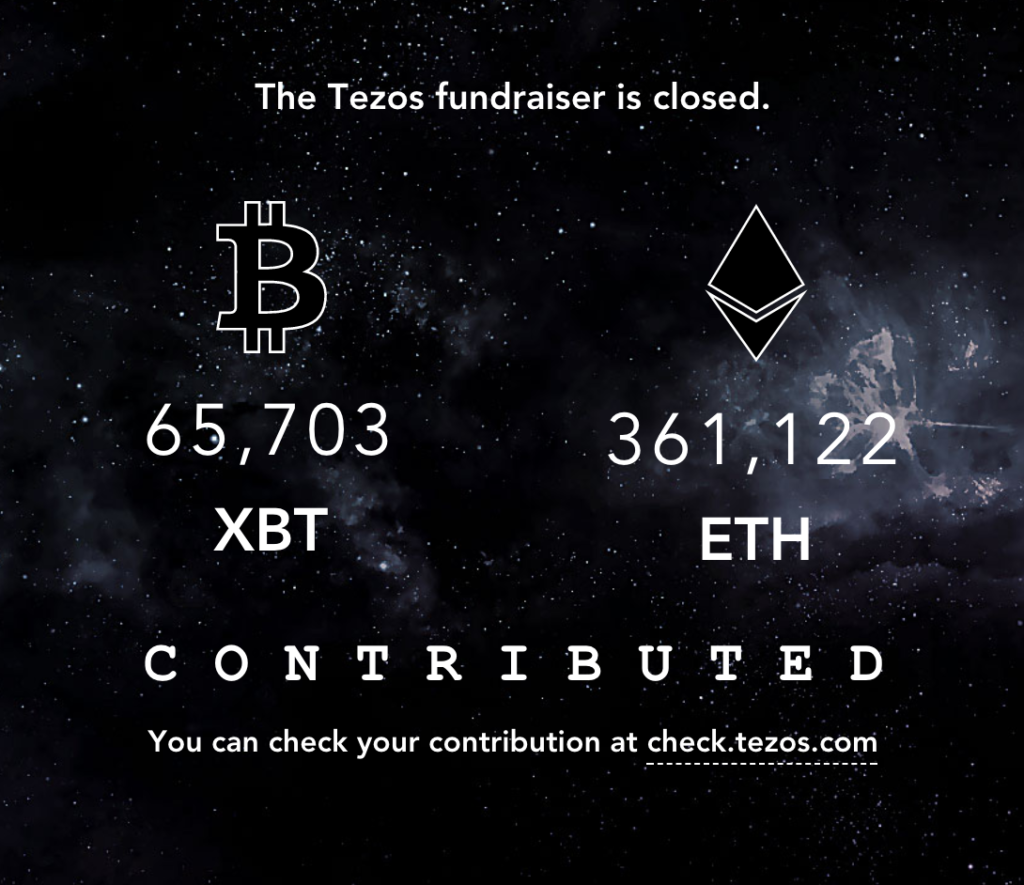

Another initial coin offering to note is by startup Tezos, which raised an astonishing 232 million USD thanks to its tokens in July 2017. Another one is Bancor, that raised 153 million USD in the first three hours of its coin crowdsale in June 2017.

A very important thing to note is that ICOs are still mostly unregulated and controversial.

Unregulated? why? Because ICOs are based on cryptocurrencies! And cryptocurrencies themselves are not fully regulated yet. They are part of a series of new technological innovations that developed really fast. Lawmakers and government institutions struggle to understand them fully, and therefore struggle to put laws aimed at governing them.

It makes sense, it took a very long time to have a solid legislation when an innovation such as the internet was invented and brought to the mainstream public. It will take even longer for other innovations like Artificial intelligence to have laws around them. Blockchain and Cryptocurrencies are also one of these kind of technological inventions, and it will take time as well. For now regulation is lacking, and that can be a good but also a bad thing, and this is why I said a that ICOs are mostly unregulated AND controversial. Let’s expand a bit on the controversial aspect.

For the first time in history, a tech startup can raise capital bypassing the very rigorous and regulated capital-raising process that is required by banks or venture capital firms. This is a great thing for the acceleration and proliferation of innovation, because tech startups are not limited by the mercy of banks and financial firms anymore. They can go themselves in front of investors directly, communicate their vision and product, raise funds, and reward who believed in them and contributed money.

You also don’t need to have a product ready to launch and conclude a successful ICO. You just need at minimum a very good looking website, a detailed whitepaper explaining your idea and concept, and a clear roadmap of what your company plans to do in its first years of operation. It is a truly free market.

But do you start to see the bad side of all this? Scams, scams scams and all kind of financial fraud are possible and easy to accomplish. I can have a vision, a clear roadmap ahead, and a lot of great promises, but at the end of the ICO I can just run away with millions of dollars of capital without serious legal repercussions. Nobody is regulating this environment, therefore who is gonna put me in jail? Nobody.

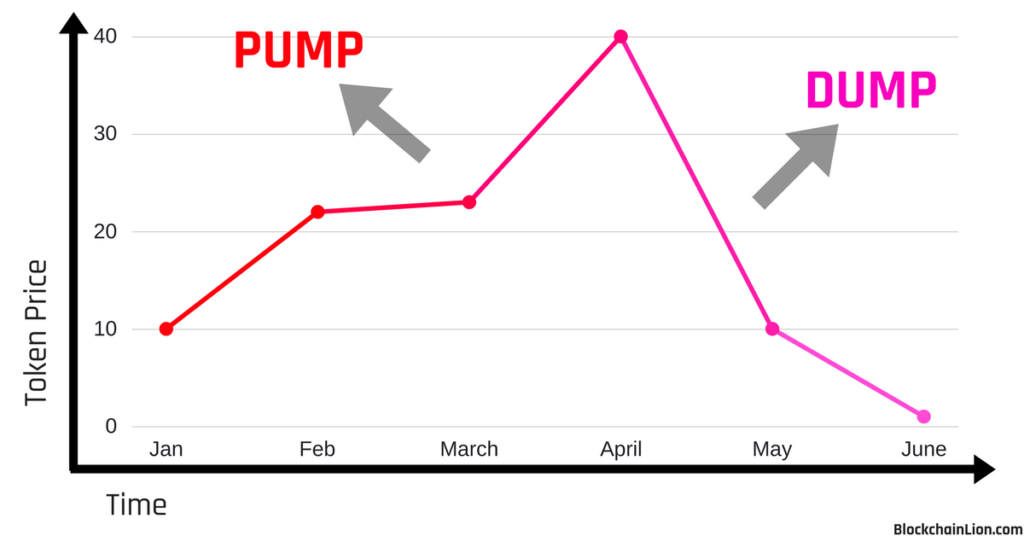

The US Securities and Exchange Commission (SEC) has in fact warned investors to be very careful about “pump and dump” schemes. These are frauds where the issuers of these ICOs will create their token. After issuing their tokens, they will drive the price up in value by having a large amount of investors buy it (pump), and then sell (dump) their part of the tokens before everyone does, making a great profit and leaving investors with worthless tokens in hand.

Another type of fraud commonly seen in ICOs are Ponzi schemes. Yes! Ponzi Schemes! They are back! Again this is all thanks to virtually no regulation in the area. It’s the El Dorado of scam artists.

These really bad episodes have forced some countries to completely ban ICOs in order to protect their investors. One of these countries is China, which banned ICOs on september 4th, and later announced that it is only a temporary ban. The ban will be lifted when the government will be able to fully understand the complex ICO ecosystem and finds a way to regulate it.

In summary, an ICO is a way to raise capital. As an investor you send bitcoins or ethereum to a certain company you believe in, and after the ICO is over you receive a certain amount of digital token in proportion of how much you contributed during the ICO. This token is a proof of your contribution. Tokens will appreciate in value if the company is successful. Tokens usually can be later used in the company’s platform/product or can be exchanged back to bitcoin, ethereum, US dollars or any currency.

Now you should also have a clear picture of the good and bad sides of the concept of initial coin offering. It is an unregulated universe, where a lot of good things can happen, but also where a lot of bad things find their way in.

What are the numbers in ICOs? Well, a total of 1.67 billion USD via initial coin offerings (ICOs) has been invested into blockchain startups so far. This compares to an 1.8 billion USD invested through traditional venture capital firms (data from https://www.coindesk.com/ico-tracker/). This highlights how ICOs are becoming a stronger way for companies to raise capital.

Why so much growth in ICOs? The most important reason in my opinion is that there is a lack of experience in the market about failure. All these blockchain startups are showing extremely innovative business models, and have disruptive visions that promise to revolutionize traditional systems. But since they are all starting now, the public has not seen any of them fail yet, so there is a global optimism that pushes more and more money into it.

I think it will be very interesting next to compare this ICO climate with past periods in history when new technological innovations made their way into our economy.

A discussion about ICOs and history

Blockchain is a truly big revolution of technology, we can all agree on that. It introduces a new way of sharing and storing information. It serves as a foundation upon which you can build countless of applications and business models, across every vertical.

What was the last infrastructural innovation in history that enabled so much disruption? Well it was for sure the internet. The internet was a crazy revolutionary concept at the time, and it created the basis upon which society over time started sharing more and more information and operating most of its business infrastructures.

The interesting thing to note is that it took a very very long time for the internet to become mainstream, and power a significant part of many industries. Actually some areas of business are still not fully digitized and on the internet yet.

So if it took decades for the internet technology to grow and be implemented across all the industries, how long will it take for blockchain to also become mainstream?

Very hard to answer, but for sure also a very long time.

I was a little kid when the internet was developed and the first internet startups were born, so I cannot tell exactly what was going on back then, but I bet it was very similar to the current ICO and blockchain climate. In fact, the more I researched the dotcom bubble, the more it seemed that having the word “internet” in your company’s product name was enough to attract hordes of investors into buying your stocks. Now, analogously if you have the word “blockchain” in your company’s marketing material you can be sure to attract the same kind of hype.

So in both periods there was a huge driving force that attracted a lot of money from the public. That strong force is called FOMO, which stands for Fear of Missing Out. In fact when you hear that your friend, your neighbor or the average guy on the internet is getting rich overnight thanks to cryptocurrencies and ICOs, you immediately feel the urge of jumping on the train as well. This sets a chain reaction, and it is why huge amounts of money go into these kind of new companies and assets.

What happened at the apex of the dotcom bubble in the 2000s was that a lot of these super promising internet startups failed. Why did they fail? Well as a software engineer I can tell you that it is very easy to come up with concepts, and prototypes. But when it comes to building a fully functional product and a business around it, it’s a whole different story. Many variables can fail unexpectedly and even if you accomplish the task of creating your product, you still need to be in overall profit.

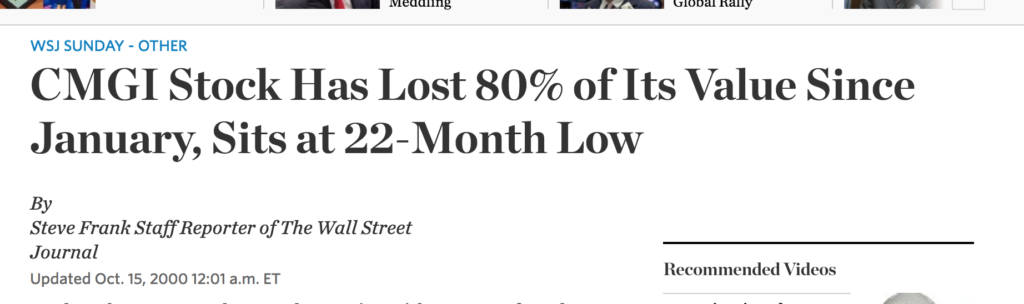

So a lot of these stocks, like for example CMGI, an incubator of internet companies, went from 15$ a share to more than 300$ per share during the optimism period. Then as the bubble popped, it crashed to reach a value of 0.28$ a share.

Is the dotcom bubble repeating itself now with the current ICO climate? As I just pointed out there are so many similarities, such as the common optimism for these disruptive startups, the hope of a more efficient society, and the overnight millionaires popping out left and right.

But the answer to that question is not that simple to give, we are still very early in the blockchain lifecycle and we haven’t reached the same numbers yet. The majority of the population still has no idea of what blockchain or bitcoin is. The more newcomer investors flow into the space, and the more the excitement will continue.

The only thing to do is to be a smart investor and minimize every chance of failure. As I said before, many of these startups will fail and their token value will collapse. It is impossible that every venture will be profitable. Just like in the Dotcom bubble, only a few companies such as Yahoo, Google and Amazon were able to survive and thrive.

I will probably write a separate article on how to be a good ICO investor, which includes doing extensive research about the startup team, looking at how much of the actual softwares is being developed by looking at the team developers’ Github pages and other type of research diligence.

Nothing important has ever been built without irrational exuberance and blind optimism. Nothing. It is good to see a lot of money coming into this new market, it helps accelerating the development of this technology, it did help the internet back then, and it will help blockchain now.

There is a latin saying that goes by: “historia magistra vitae”, which means that the history is the teacher of our life. So can we find even more examples in history other than the dotcom bubble? Absolutely, let’s travel back in time and think about another big technological innovation of the 1900s: cars.

Cars were really hot in the 1900s, so what happened was a boom in car manifacture companies. Want to see what’ I’m talking about? Take a look at this wikipedia page: https://en.wikipedia.org/wiki/List_of_defunct_automobile_manufacturers_of_the_United_States . As you can see there were an astonishing number of companies that jumped in the car business that now are defunct either because of bankruptcy, mergers or being phased out.

Now that you saw that long list, take a look at how many tokens and cryptocurrencies we have currently in the market. All of them riding the wave of the new disruptive technology: blockchain.

Another example? Let’s go back to the 1800s! Back then the technological innovation was Trains, and railroads. So in that period we had the same kind of situation, which had a name: “Railroad mania”. Again, most of the companies did not survive, while a select few saw enormous success.

This journey back in time should only reassure us that what we are living now with blockchain and all these ICOs is part of the natural human history. I might be wrong, but I strongly believe that blockchain technology, just like the internet, cars and railroads, will revolutionize our society by providing a stronger foundation that businesses will use to improve our lives in countless ways.

I would like to send special thanks and a big note of merit to all these companies and startups that are going out there right now with transparency, best intentions and a strong team spirit in order to pioneer various uses for this amazing technology called blockchain. All these people are laying the groundwork for future infrastructure.

How to buy cryptocurrency

You can buy cryptocurrencies by transferring your fiat currency to Coinbase and exchange it for bitcoin, ethereum or Litecoin. Use this link to get a 10 USD (8 EUR) bonus in bitcoin when purchasing 100 dollars (80 EUR) or more in cryptocurrencies.

Post-ICO tokens are sold/bought in crypto exchanges like binance, cryptopia or HitBTC. You can make an account in these exchanges, and then use it to purchase any ICO token that you want.

Conclusion

What do you think about these comparisons I made? Do you agree or disagree? Are ICOs a totally different situation or will they behave like any past big technological innovation? Leave a comment! I would love to hear your point of view and have as many different opinions as possible.

2 thoughts on “Initial Coin Offering 101 – All you need to know”

Comments are closed.